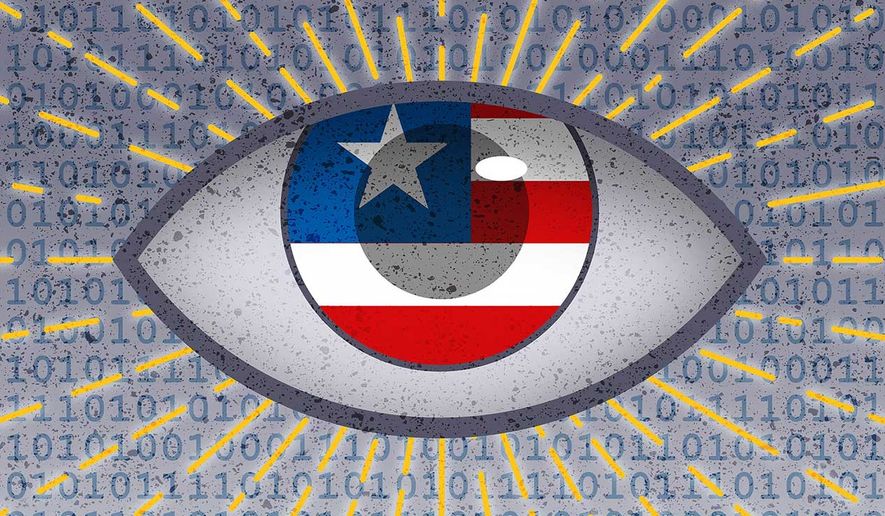

The public and private push to track online your every transaction

(The Washington Times) – That $1 bill in your wallet or purse, like any other greenbacks you might be carrying, declares it is a “Legal Tender for All Debts Public and Private.” Not anymore.

Breaking the law, more and more businesses reject your Federal Reserve Notes. To paraphrase the banditos pretending to be Federales in the film classic “The Treasure of the Sierra Madre,” they don’t need no stinking currency laws.

In Washington, Major League Baseball’s Nationals Park declares itself a paper-money-free zone. Plastic only, and no please or thank you. A popular coffee shop in my northern Virginia suburb posts a front-door sign asserting “credit cards only.” As for the automatic kiosk in the parking garage of my office building, for years, the payment screen showed two digital buttons, one for credit or debit card, touch two for cash and coins. Button two is still there, but X’d out. Push all you want; your bills and change are worthless.

What’s the problem, you may ask? Washington Post personal finance columnist Michelle Singletary hinted at it in a recent column headlined “Accepting wedding gifts via Venmo? The IRS shouldn’t be party-crashing.” Ms. Singletary noted that due to a change in the law, all third-party payment processors like Venmo and PayPal “must report payments of more than $600 a year received for goods and services.”

Now, “a single transaction or multiple payments that exceed $600 can trigger a 1099-K [federal tax form]. It’s harder to avoid having the IRS find out your earnings when there’s a digital trail” — even when the money comes from gifts.

True, paying with plastic, in person or online, can be much more convenient. Not to mention sanitary.

But the threat to individual liberty from one’s ever-extending, ever-tightening digital money trail is that it lays bare so much of one’s previously private life. Our digitized financial existence, from automatic deposit through online shopping, restaurant payments and movie tickets to charitable and political contributions, tells whoever’s watching — the feds, criminals, Chinese hackers — far too much about us.

The Bill of Rights’ Fourth Amendment famously asserts “the right of the people to be secure in their persons, houses, papers and effects, against unreasonable searches and seizures.” But with the web vacuuming up pieces of our lives each time we plop down the plastic, the Fourth Amendment, like paper money as legal tender, becomes less and less the law of the land. We’re searched and our data, at least, has been seized with each non-cash transaction. Like our smartphones tracking our physical locations for Big Tech and potentially Big Brother. (Are you sure tomorrow’s phones will still let you disable tracking?)

The generation that willingly, even obsessively posts the most mundane details of its existence on Facebook, Instagram, TikTok (a functional subsidiary of Chinese intelligence), and the rest, erasing the civic — not to mention psychological — distinction between public and private, seems not to understand the danger.

Here’s a clue: In George Orwell’s “1984,” Big Brother was always watching, and he was pre-digital. Today’s China, under its Communist Party, suffers the world’s most thorough surveillance dictatorship. A key tool of the apparent Emperor for Life, President Xi Jinping, and his omnipresent jailers and executioners is their “social credit” system. It tells subjects — like ancient empires, China has no citizens — that “keeping [the government’s] trust is glorious, breaking trust is disgraceful.”

Played too many video games? Made other “frivolous purchases”? Posted what officials deem “fake news” (in a one-party system, perhaps real news) online? Just got crosswise with your neighborhood “information gatherer”? It can all go into your social credit score. Consider it the ideological/moral equivalent of late payments affecting your U.S. credit rating.

And if your social credit ranking is low? Travel restrictions, employment rejections, decreased internet speeds, and your children barred from desired schools. Even reduced heat. Or worse, the dreaded late-night knock on the door.

In America, Big Tech already de-platforms those, usually conservatives, it assigns low “woke credit scores.” It’ll be even easier for Google or the government to do so when, as the Steve Miller Band sang nearly half a century ago, “Your Cash Ain’t Nothin’ but Trash.”